Charting Your Course:

Key Strategies for Successful Growth Planning

Growth planning is a crucial aspect of running a successful business, ensuring that you envision the future of your company and create a strategic plan to propel it towards that future. It involves forecasting the resources needed, setting achievable goals, and formulating strategies to achieve those goals, all while maintaining a balance to avoid common pitfalls such as cash flow problems. This article delves into the intricacies of growth planning, providing valuable insights and practical advice to help business owners navigate their growth journey with confidence and precision.

The Importance of Growth Planning

Business owners are inherently risk-takers, but that doesn't mean they should be unprepared when it comes to the future of their business. Growth planning is about envisioning your business's future and then creating a plan to launch your brand into that future. This means forecasting to see how much cash you'll need to get there and evaluating how much growth is possible given the resources you have on hand, as well as how long it will take your company to grow within those limits.

Growth planning is not merely about predicting the size of your business in a few years or setting revenue goals for the next few quarters. It also involves thinking through the operational aspects required to achieve those goals—such as the number of employees you'll hire, the inventory you'll need to purchase, the marketing strategies that will be most effective, and the partnerships that will help propel you forward.

Building a Solid Growth Plan

Once you've built a solid plan for scaling up your business without strangling it or running out of cash, you can begin implementing that plan with confidence and peace of mind. You're not just gambling with your livelihood; you're betting on a sure thing. Here are some key components to consider when developing your growth plan:

Cash Management

When you're planning for growth, your business plan will always come back to the amount of cash you have available in the company. Scalability is then about how much money you have to invest in that growth and whether your company can grow without being hampered by its Processes, People or Systems.

How, when and where you invest your profits are the core drivers of growth. With scalability, finding balance is critical. Expanding too quickly can be

as detrimental as expanding too slowly. The answer lies somewhere in between, and it depends on a number of factors: what stage your business is at; how much you want to expand; how fast you want to expand; and how far you are prepared to stretch yourself and your finances.

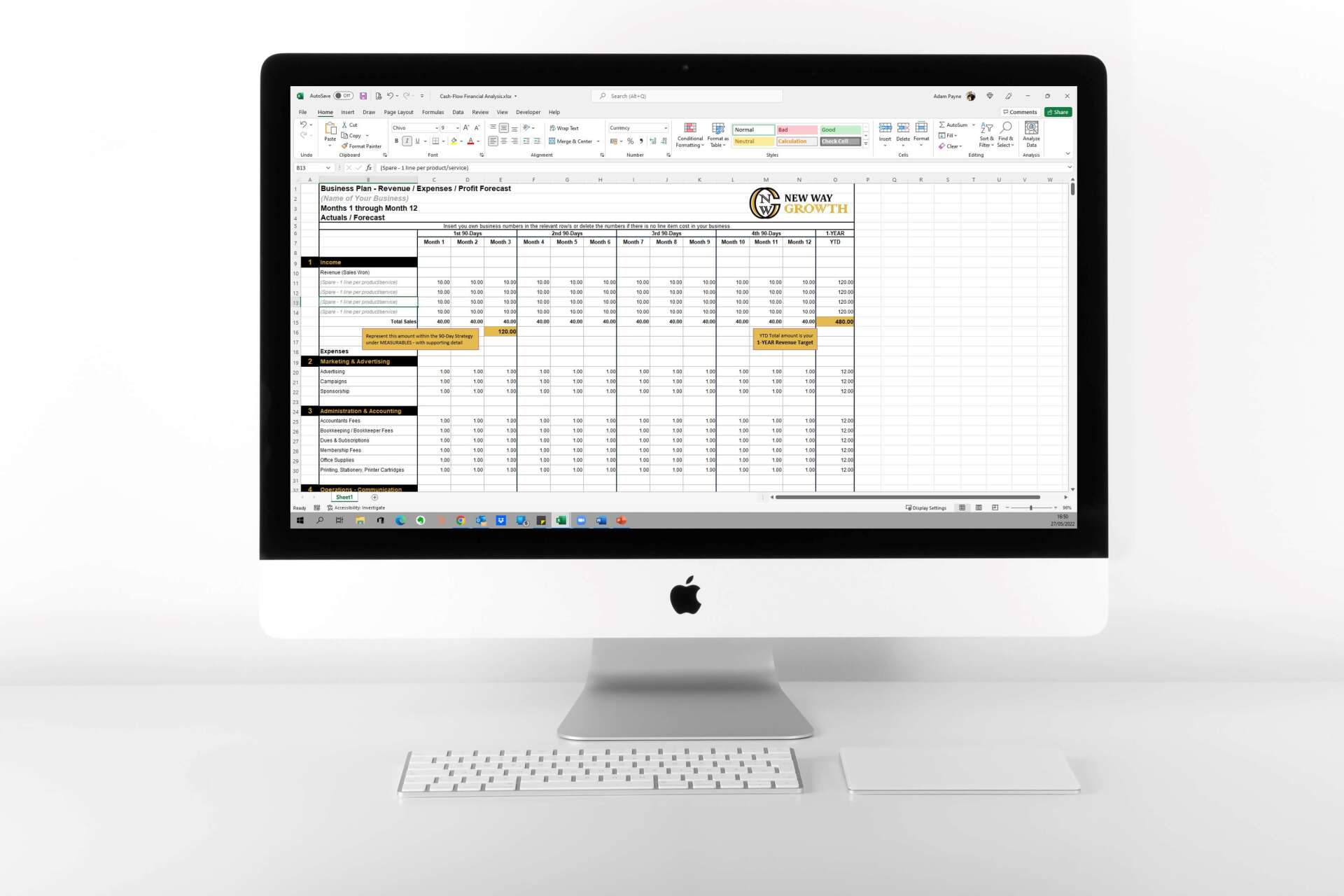

Forecasting Model

The future is unknown. But you can predict it with a good confidence level.

For all businesses, forecasting the ups and downs of the market is an invaluable tool. A good forecasting model will not only help you plan for the future with confidence, but it can also help you avoid expensive mistakes that may cost your company time and money in the long run.

In order to build a good forecasting model, you need to know what kind of information you need to have on hand. In general, your model should include:

- information about your current cash flow (and how much cash you have on hand)

- financial projections for your company in the short term (3 months) and long term (3 years)

- an idea of how much money you want to spend on reinvestment each year

- a target profit margin

- an idea of how much money you want to spend on reinvestment each year

Your model should provide a clear picture of where your business is headed both short- and long-term, allowing you to make informed decisions about how to invest your cash and resources.

Key Strategies for Successful Growth Planning

Growing your business can be both exciting and challenging. When you're in the business of making more money, you need to ensure that your investment choices are wise. However, this can be tough when there's so much pressure to succeed. Here are some strategies to help you navigate the growth planning process:

Smart Incremental Changes

Don't rush yourself into making a big splash, or you might miss out on a bigger opportunity that lasts. Focus on making smart, incremental changes that build on one another, starting with profits you can count on. This approach allows you to grow steadily without overextending your resources or risking financial instability.

Taking Calculated Risks

Taking risks is part of being a business owner, and sometimes it's worth it. You just have to be able to look at yourself and say, "I'm confident enough in this risk that I'm about to take." Calculated risks involve thorough analysis and consideration of potential outcomes, ensuring that you are prepared for various scenarios and have contingency plans in place.

Ensuring Business Survival

One of the most significant challenges businesses face during growth is maintaining positive cash flow. To ensure your business's survival without falling victim to cash flow problems, it's essential to have a straightforward cash flow template. This tool can help you manage cash flow challenges with confidence, freeing up time for what really matters—accelerating your business growth.

Practical Tips for Effective Growth Planning

To further aid in your growth planning efforts, here are some practical tips and resources that can help you navigate the complexities of scaling your business:

Leveraging Financial Tools

Utilising financial tools such as cash flow templates, budgeting software, and financial forecasting models can provide valuable insights and help you make informed decisions. These tools allow you to track your financial performance, identify potential issues early, and adjust your strategies accordingly.

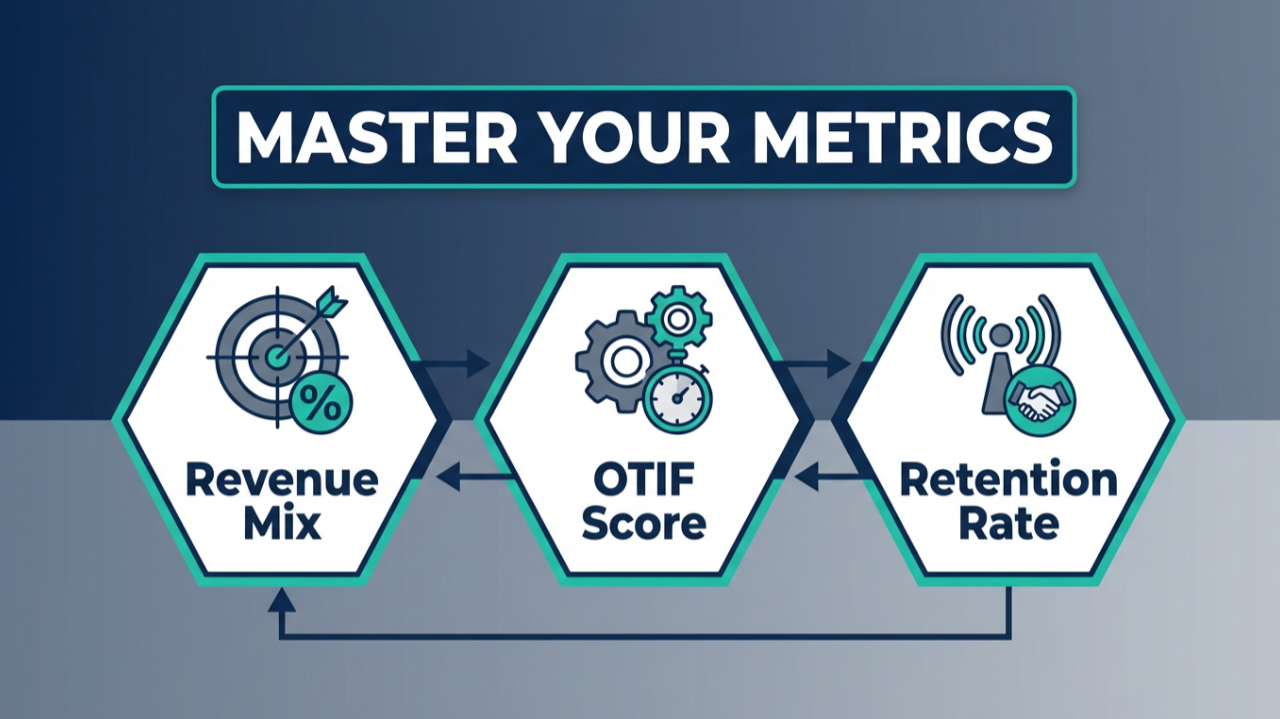

Setting SMART Goals

Setting SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals is crucial for keeping your growth plan on track. These goals provide clear direction and benchmarks for success, ensuring that your efforts are focused and aligned with your overall business objectives.

Continuous Monitoring and Adjustment

Growth planning is not a one-time effort; it requires continuous monitoring and adjustment. Regularly review your progress, assess the effectiveness of your strategies, and make necessary changes to stay on course. This iterative process allows you to adapt to changing market conditions and capitalise on new opportunities.

Seeking Expert Advice

Consulting with business advisors, financial experts, and industry peers can provide valuable perspectives and insights. These experts can help you identify potential pitfalls, refine your growth strategies, and offer guidance based on their experience and expertise. Shameless plug here, this is one of our specialist areas 😁.

Takeaway[s]

Growth planning is a vital component of running a successful business, enabling you to envision the future and create a strategic plan to achieve your goals. By carefully managing cash flow, building robust forecasting models, and implementing smart growth strategies, you can navigate the complexities of scaling your business with confidence. Remember to take calculated risks, make incremental changes, and continuously monitor your progress to ensure sustained growth and long-term success.

For more information on growth planning and to access valuable resources, explore our website and contact us for personalised guidance and support.

Additional Resources:

For further reading on related topics, consider exploring the following articles:

For personalised advice and support on growth planning, contact us today to schedule a consultation with our experts.

Message Us:

Contact Form

Phone: 0330 311 2820

We look forward to helping you achieve your business growth goals.